In an era of renewed economic nationalism, former President Donald Trump’s return to the White House in 2025 has ushered in a sweeping tariff regime aimed at reshaping global trade. Proclaimed as a tool to “make America great again” by protecting domestic industries and reducing trade deficits, these tariffs—now averaging 27% on imports, the highest in over a century—have sparked intense debate. Yet, a closer examination reveals a counterintuitive reality: while intended to punish foreign competitors, Trump’s tariffs disproportionately harm the United States itself. American consumers, businesses, and the broader economy bear the brunt, facing higher prices, disrupted supply chains, and stunted growth. This article delves into the mechanics of tariffs, their real-world effects on Americans, and why they boomerang back on the imposing nation, supported by economic analyses and recent data from 2025.

Table of Contents

Understanding Tariffs: The Basics of How They Operate

At their core, tariffs are taxes imposed by a government on imported goods and services. They are not a novel concept—countries have used them for centuries to generate revenue or shield local industries from foreign competition. In the context of Trump’s policies, tariffs function as a barrier to entry for overseas products, making them more expensive in the U.S. market. The process begins when a foreign exporter ships goods to the U.S. Upon arrival at a port or border, the U.S. importer—typically an American company—must pay the tariff to U.S. Customs and Border Protection. This payment is calculated as a percentage of the goods’ value, often including freight and insurance costs.

Crucially, the foreign country or exporter does not directly pay the tariff; the financial burden falls on the U.S. importer. Importers, in turn, have limited options: absorb the cost (reducing profits), pass it on to consumers through higher prices, or seek alternatives like domestic suppliers—if they exist. In practice, a combination occurs, but empirical evidence shows that U.S. consumers and businesses absorb the majority of the cost. For instance, during the initial rollout of Trump’s tariffs in early 2025, importers absorbed about 22% of the costs by June, with projections rising to 67% by October as pass-through to consumers accelerated.

Tariffs also invite retaliation. When the U.S. imposes duties, affected nations often respond with their own tariffs on American exports, escalating into trade wars that further complicate global commerce. This dynamic not only raises costs but disrupts supply chains, as seen in the agriculture sector where retaliatory tariffs from countries like China have hammered U.S. farmers.

A Simple Example: The Smartphone Tariff Scenario

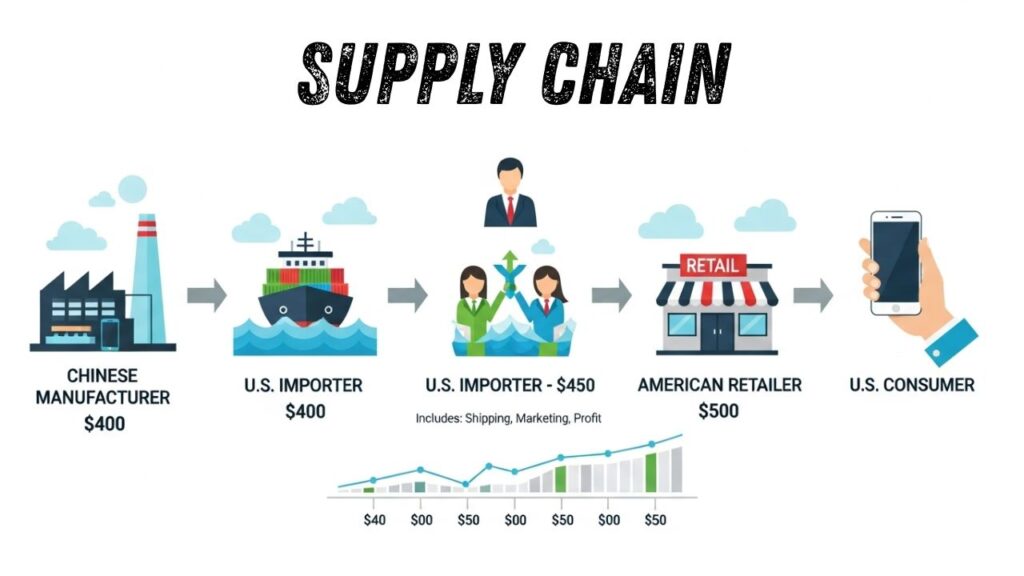

To illustrate how tariffs function and their ripple effects, consider a straightforward example involving a popular consumer product: a smartphone imported from China.

- Pre-Tariff Scenario: A Chinese manufacturer sells the smartphone to a U.S. importer for $400. The importer adds costs like shipping, marketing, and profit margins, selling it to American retailers for $450. Retailers then mark it up to $500 for consumers. Everyone along the chain makes a reasonable profit, and the end price remains competitive.

- Post-Tariff Scenario: Trump imposes a 25% tariff on Chinese electronics, a common rate under his 2025 policies. Now, the U.S. importer must pay an additional $100 (25% of $400) to the U.S. government upon import. Their total cost jumps to $500. To maintain profitability, the importer raises the price to retailers to $550. Retailers, facing their own margins, push the consumer price to $600 or more.

In this case, the Chinese manufacturer might see reduced demand if sales drop, but they aren’t paying the $100 tariff—the U.S. importer is. If the importer can’t switch to a domestic alternative (as smartphone production is heavily concentrated abroad), the cost is passed downstream. The American consumer ends up paying $100 extra, effectively subsidizing the tariff. Multiply this across millions of products—from electronics to clothing—and the cumulative effect is widespread price inflation without directly harming the foreign exporter as intended.

This example underscores a key economic principle: tariffs act as a regressive tax, disproportionately affecting lower-income households who spend a larger share of their income on imported goods.

Why Tariffs Hurt the USA More Than Targeted Countries

Proponents argue that tariffs force foreign nations to negotiate better deals or lose market access, ultimately benefiting the U.S. However, economic models and real-world data paint a different picture: the U.S., as a large importer, absorbs most of the pain.

First, the incidence of the tax falls domestically. Studies from institutions like the Tax Foundation and Wharton School indicate that tariffs raise prices and reduce the quantity of goods available, creating an economic burden equivalent to a domestic tax. Foreign exporters may lower prices slightly to maintain competitiveness, but this absorption is minimal—often less than 10%—leaving Americans to foot the bill.

Second, retaliation amplifies the damage. Countries like the EU, China, and Canada have imposed counter-tariffs on U.S. exports such as soybeans, whiskey, and steel, leading to lost sales abroad. This has devastated export-dependent sectors; for example, over 30% of Arkansas farmers face bankruptcy risks in 2025 due to combined tariff effects and weather, though tariffs exacerbate market access issues.

Globally, targeted countries can redirect exports elsewhere. China, for instance, has pivoted to markets in Asia and Europe, mitigating losses while the U.S. grapples with higher input costs for manufacturers. Economic projections show Trump’s 2025 tariffs, plus retaliation, could shave 0.5 percentage points off U.S. GDP growth annually. Long-term, models predict a 6% GDP reduction and 5% wage drop, with middle-income families facing a $22,000 lifetime hit.

In contrast, foreign economies experience temporary dips but often recover through diversification, while the U.S. dollar strengthens (making exports pricier), further eroding competitiveness.

The Direct Toll on Americans: Consumers, Businesses, and Jobs

The human cost of tariffs is felt most acutely by everyday Americans. For consumers, tariffs manifest as “sneakflation”—gradual price hikes across goods. Estimates suggest households could pay an extra $2,400 annually in 2025, with some projections reaching $5,200 for broader impacts. Essentials like appliances, vehicles, and clothing see the sharpest rises; for instance, tariffs on steel have increased car prices by hundreds of dollars. <post:30 from X mentions citizens realizing impact on finances.

Businesses face chaos. Importers and manufacturers reliant on foreign inputs—like auto makers using imported parts—see costs soar, leading to reduced profits or layoffs. In California alone, tariffs could cost over 64,000 jobs and $25 billion in household expenses. Supply chain disruptions have delayed production, as seen in the tech sector where Indian IT services face 50% tariffs, potentially hiking costs for U.S. firms. <post:29

On jobs, tariffs protect some (e.g., steelworkers) but destroy others in downstream industries. Net effects are negative: slower hiring, with August 2025 jobs data showing weakening amid tariff pressures. Farmers, hit by retaliation, have required billions in bailouts, highlighting policy’s inefficiency.

| Sector | Positive Effects | Negative Effects | Net Impact (2025 Projections) |

|---|---|---|---|

| Manufacturing (Protected) | Job preservation in steel/aluminum | Higher input costs for autos/electronics | -1.2% output decline |

| Agriculture | None direct | Retaliatory tariffs on exports | 30% bankruptcy risk in states like AR |

| Consumers | Potential shift to domestic goods | Higher prices across board | +$2,400/household costs |

| Overall Economy | Revenue boost ($38B if sustained) | GDP drag, inflation | -0.5pp GDP growth |

Broader Economic Ramifications and the Debate

Beyond immediate effects, tariffs contribute to inflation (projected 5% core CPI upgrade in 2025) and delay Federal Reserve rate cuts, as seen in discussions around Powell’s policies. <post:18 They distort markets, increasing political risk and supply uncertainty.

Arguments in favor include revenue generation (up billions in 2025) and job protection in key industries. Trump claims they encourage domestic investment and reduce deficits. Critics, including most economists, counter that they slow growth, fuel inflation, and fail to achieve goals, as evidenced by persistent deficits and harmed competitiveness. Balanced analyses show short-term wins for select sectors but long-term losses for the economy.

Conclusion: Rethinking Trade Policy for True Prosperity

Trump’s tariffs, while politically resonant, exemplify the pitfalls of protectionism: they tax Americans to “punish” others, yielding diminishing returns. As 2025 unfolds, with tariffs embedding into the economy, the evidence mounts that the U.S. suffers most—from inflated prices to lost opportunities. Policymakers must weigh these costs against alternatives like targeted subsidies or multilateral negotiations to foster genuine growth without self-inflicted wounds.